Government Loans

Venture into the world of accessible homeownership with the supportive foundations of FHA, USDA, and VA loans, each designed to make your path to owning a home smoother and more attainable. Together, FHA, USDA, and VA loans encompass a broad spectrum of opportunities, ensuring that the dream of homeownership is accessible to a diverse range of buyers, from those stepping into their first home to those serving our country.

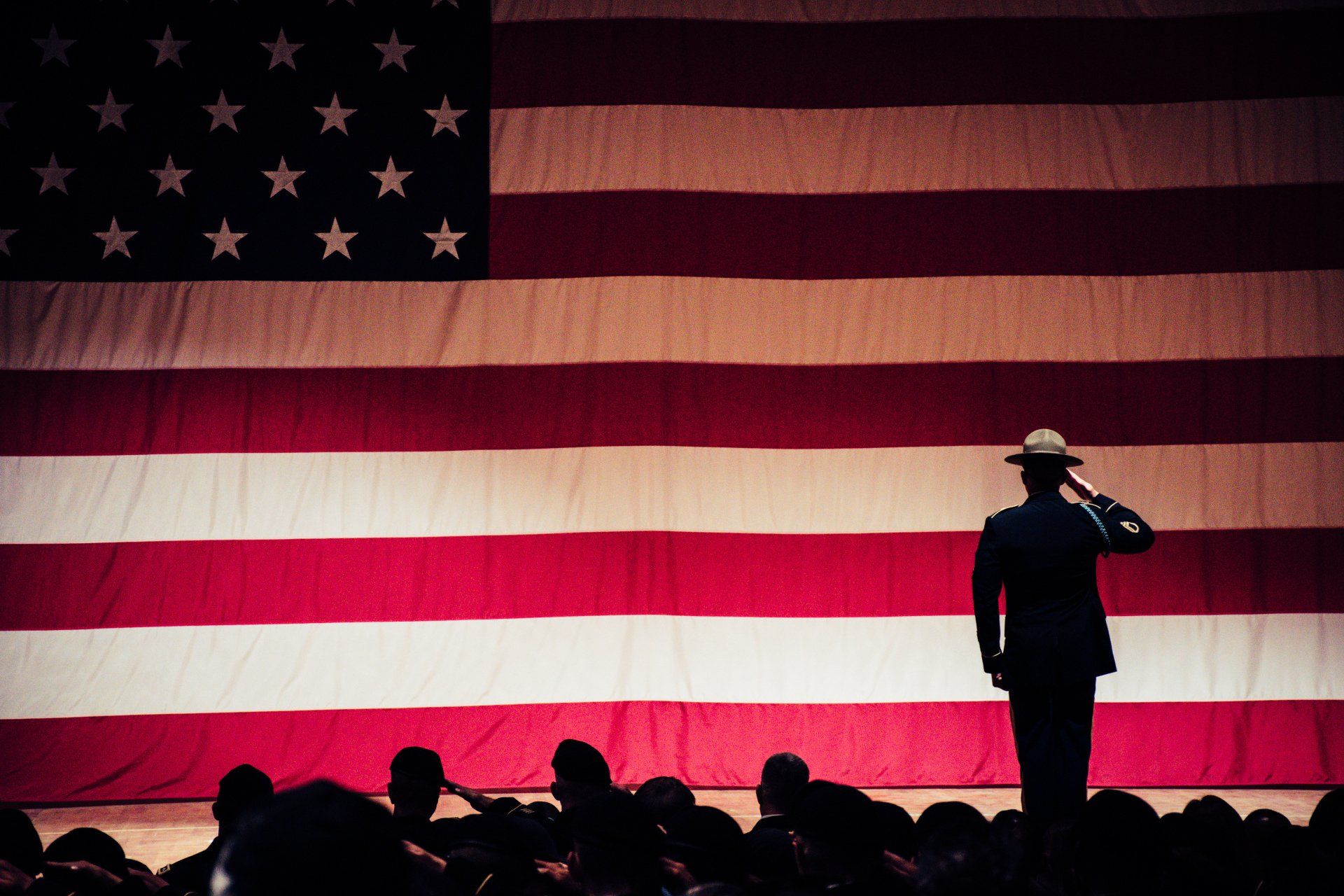

A VA loan is a mortgage loan in the United States guaranteed by the U.S. Department of Veterans Affairs (VA). Qualified lenders may issue the loan. The VA loan was designed to offer long-term financing to eligible American veterans or their surviving spouses (provided they do not remarry).

Requirements:

- Primary residence only

- Only available to eligible veterans

Benefits:

- No down payment required

- No mortgage insurance

- No cap on loan limits

- Guaranteed by the department of veteran affairs

An FHA Loan is a mortgage loan that is insured by the Federal Housing Administration (FHA). Essentially, the federal government insures loans for FHA-approved lenders to reduce their risk of loss if a borrower defaults on their mortgage payments.

The FHA program was created in response to the rash of foreclosures and defaults that happened in the 1930s, to provide mortgage lenders with adequate insurance and to help stimulate the housing market by making loans accessible and affordable.

Requirements:

- 3.5% down payment

- Primary residences only

Benefits

- Lower credit scores than conventional loans

- Popular with first time home buyers

- Government backed loans

- 1-4 unit properties eligible

The United States Department of Agriculture (USDA) gives borrowers the opportunity to own a home outside of the city limits. A USDA loan has several benefits, including flexible credit underwriting requirements and no down payment required.

Requirements:

- Only available in rural areas

- Income eligibility requirements

- Primary residence only

Benefits

- No down payment required

- Low interest rates

- Guaranteed by USDA

How Our Home Loan Process Works

The Easy 4 Steps

STEP 1

Contact us for your complimentary home loan analysis. Our experts are committed to offering you a detailed assessment that highlights the best rates and terms tailored to your unique financial situation.

STEP 2

Receive options based on your unique criteria and scenario. With this personalized analysis, you'll gain insights into how you can maximize your savings and make informed decisions about your home purchase or refinance.

STEP 3

Compare mortgage interest rates and terms. By taking into account your unique circumstances, we help you identify the most cost-effective rates and favorable terms, simplifying the decision-making process.

STEP 4

Choose the offer that best fits your needs. Once you've identified your ideal mortgage, our team will assist you through the application process, ensuring a smooth transition towards securing your home loan.

DOWN PAYMENT ASSISTANCE FINANCING

Are you having trouble saving for a down payment? Tired of paying rent but don’t think you can afford to purchase a home? You could be eligible for local and state down payment assistance programs that may cover part or all of your down payment and any additional closing costs. Talk to a loan officer today for a complimentary home loan evaluation to determine if you are eligible.

Equal Housing Opportunity Lender. Figures deemed reliable, but errors may occur. Rates and terms subject to change without notice. This is not an offer to make a loan or to make a loan on any particular terms. All loan applicants must qualify under the underwriting requirements and satisfy all contingencies of loan approval.

All loans subject to underwriter approval. Terms and conditions apply, subject to change without notice.

1204 W South Jordan Parkway, Unit CB

South Jordan, Utah, 84095

801-488-2006

Copyright ©2024 Lifestyle Lending NMLS #1915420 & #2486328

All Rights Reserved

An AgencyNext Production.